Malachi Ross is one of the most talked-about young talents in American boxing, blending elite amateur credentials with a flawless...

Body contouring procedures are increasingly planned as combined treatments to address multiple concerns in a single, structured approach. One such...

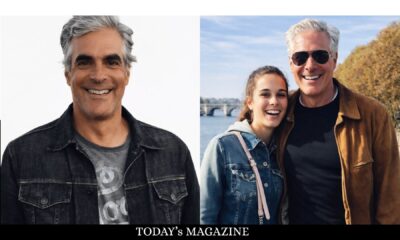

Neil Joseph Tardio Jr. is a celebrated American director whose influence reaches across commercials, television, music videos, and youth programming....

Joanna Sturm is a distinguished American historian and philanthropist whose life is deeply connected to one of the most influential...

Why Hair and Scalp Health Require Specialist Care Understanding Common Hair and Scalp Concerns Hair and scalp issues can affect...

Selecting the right carpet for your home is about more than colour or pattern. The right choice improves comfort, reduces...

Global Business Services, or GBS, has evolved into a strategic backbone for large enterprises, consolidating functions such as finance, HR,...

Artificial Intelligence (AI) is fundamentally reshaping how modern enterprises operate, compete, and scale. Organizations across industries are adopting AI to...

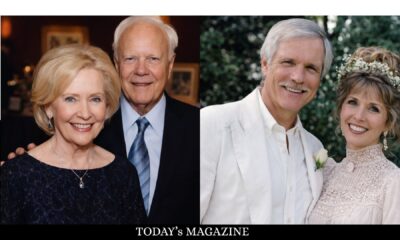

Jane Shirley Smith, often known as Janie Smith, is best remembered as the second wife of media pioneer Ted Turner,...

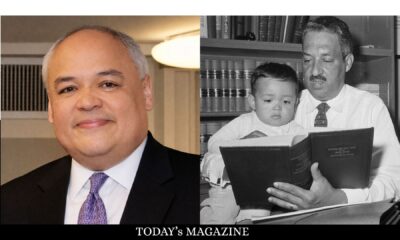

Thurgood Marshall Jr. is an American lawyer, public servant, and corporate director whose career reflects a rare blend of legal...