Business

Simon Dixon Biography: Lifestyle, Net Worth, Family, Career and Success Story

Simon Dixon is one of the most recognisable names in the global Bitcoin and fintech space. A former investment banker who transitioned into one of the earliest and most outspoken supporters of cryptocurrency, he has built an international reputation as a visionary thinker and determined reformer. As CEO and co-founder of BnkToTheFuture, he has become a central figure in democratising early-stage investing for everyday people, giving them access to fintech and blockchain companies that were once available only to elite institutions. Today, Simon Dixon stands as a pioneering entrepreneur whose influence stretches across finance, technology, education, and public commentary.

Quick Bio

| Category | Details |

|---|---|

| Full Name | Simon Dixon |

| Date of Birth | November 1980 |

| Age | 45 years old |

| Nationality | British |

| Profession | Entrepreneur, Investor, CEO of BnkToTheFuture |

| Known For | Early Bitcoin advocacy and fintech investment |

| Net Worth | Estimated multi-million (varies with crypto markets) |

| Education | Finance and investment background |

| Notable Book | Bank To The Future |

| Marital Status | Private |

| Residence | UK & international travel for business |

| Industry | Bitcoin, blockchain, fintech, investment banking |

Early Life and the Foundations of a Financial Mind

While Simon Dixon keeps many aspects of his personal life private, it is clear that his interest in finance began early. Growing up in the United Kingdom, he showed a strong fascination with how money works, how banking systems operate, and why some people seem to thrive financially while others struggle. This early curiosity shaped his academic direction and pushed him to pursue formal training in finance and investment.

Dixon was analytical, questioning, and deeply interested in the mechanisms that underpin global economic behaviour. Instead of simply accepting the banking system as it was, he wanted to understand its strengths, flaws, and hidden dynamics. His early education and training in finance gave him the intellectual tools to explore these ideas, while his natural curiosity encouraged him to challenge conventional thinking. These formative years set the stage for a career built on innovation, disruption, and a desire for greater transparency in financial systems.

Becoming an Investment Banker and the Turning Point

Simon Dixon’s professional journey began in traditional finance. After completing his academic training, he qualified as an investment banker in the UK. He entered a world characterised by complex financial structures, high-stakes decision-making, and a rigid hierarchy of power. For most aspiring bankers, this career was the ultimate achievement, promising stability, prestige, and financial reward.

Yet Dixon found himself increasingly troubled by the inner workings of the system he had joined. The global financial crisis of 2008 became a major turning point for him. He saw firsthand how flawed incentives, unnecessary complexity, and lack of transparency had contributed to systemic instability. His belief in the banking structure began to crumble as he witnessed how the crisis affected ordinary people, small businesses, and national economies.

Instead of continuing down a traditional career path, Dixon began to search for alternatives. He wanted a financial system that was more equitable, more transparent, and more technologically advanced. This search led him to the world of cryptocurrency, years before it became a mainstream concept.

Discovering Bitcoin and Shifting Toward a New Future

Simon Dixon encountered Bitcoin during its earliest years, when it was still largely unknown outside small online communities. For him, Bitcoin represented more than just digital currency. It represented a completely new way of thinking about money, value, and financial freedom. He recognised immediately that blockchain technology could transform global finance, remove unnecessary intermediaries, and empower individuals in a way traditional banking had failed to do.

While many dismissed Bitcoin as a temporary trend, Dixon saw it as the foundation of a financial revolution. He became an early public advocate, speaking at conferences, creating educational content, and explaining Bitcoin to investors, bankers, and the general public. His ability to break down complex concepts into simple explanations made him one of the most influential educators in the crypto world.

At a time when very few in the mainstream understood or believed in digital assets, Simon Dixon stood at the forefront, pushing for adoption and encouraging innovation. His early involvement positioned him as a global authority on cryptocurrency years before the market exploded into public view.

Creating BnkToTheFuture and Democratizing Investment

In 2010, Simon Dixon co-founded BnkToTheFuture, an online investment platform designed to give people access to early-stage fintech and blockchain companies. His goal was simple: create a transparent, accessible, and secure way for investors to participate in the future of finance. Traditional venture capital was often limited to insiders, institutions, and wealthy investors, but Dixon believed opportunities should be open to a wider audience.

Under his leadership, BnkToTheFuture grew into one of the largest global investment platforms for fintech and crypto. Today it serves tens of thousands of investors worldwide and has helped fund over US$170 million in investment rounds. Many of the companies showcased on the platform have gone on to become major players in the cryptocurrency ecosystem.

Dixon’s vision with BnkToTheFuture was not just financial. It was ideological. He wanted to address the fundamental problems of traditional banking, particularly the lack of transparency. By building a platform that prioritised openness, accountability, and accessibility, he set a new standard for how financial investments could operate in the digital age.

Expanding Influence Through Public Speaking and Media

Simon Dixon quickly became known for his ability to captivate audiences. He is widely recognised as an award-winning public speaker with a distinctive style that blends education, humour, and bold prediction. Whether speaking to seasoned investors or newcomers just learning about Bitcoin, he makes financial topics engaging and approachable.

Major media outlets turned to him regularly for commentary. His insights have been featured in the BBC, Financial Times, Reuters, the Wall Street Journal, and major business broadcasts. As cryptocurrency grew, he became a leading voice in explaining how digital assets would reshape global finance.

His live broadcasts, interviews, and detailed financial analyses have attracted a loyal international following. Dixon’s strong media presence has made him a trusted authority and a reliable source of perspective during major market events, including dramatic market crashes, corporate failures, and regulatory developments.

Investments in Leading Crypto Companies

As an active fintech and Bitcoin angel investor, Simon Dixon has invested in many of the companies that shaped modern digital finance. His investment portfolio includes early positions in platforms such as BitPay, Kraken, Bitfinex, BitPesa, BitStamp, and others. These investments were not only financially successful but also strategically aligned with his mission to support decentralised and transparent financial solutions.

Dixon’s foresight allowed him to identify potential long before the mainstream caught on. His investments helped fuel innovation across payment systems, exchanges, and blockchain infrastructure. Many of these companies have since grown into industry pillars.

His role as both an investor and influencer allows him to contribute more than capital. He provides strategic guidance, industry insight, and long-term vision, helping early-stage companies navigate the rapidly evolving financial landscape.

The Vision Behind Bank To The Future

Simon Dixon’s book Bank To The Future became an important guide for readers trying to understand how technology would disrupt financial systems. In the book, he outlines key problems within traditional banking structures and explains how innovations like Bitcoin and blockchain can provide solutions.

Dixon emphasises transparency, decentralisation, and user empowerment as the foundations of a stronger financial future. His writing is known for its clarity, confidence, and ability to simplify complex subjects without losing depth. The book solidified his reputation as both an educator and a visionary, and it remains a widely referenced work in fintech and cryptocurrency circles.

BnkToTheFuture’s Plan to Become an Investment Bank

One of the most ambitious developments under Simon Dixon’s leadership was the announcement that BnkToTheFuture intended to transform itself into an investment bank. The company sought to raise £2 million from its users in exchange for a 25 percent equity stake. This bold crowdfunding initiative reflected Simon Dixon’s unwavering belief in community-driven finance.

His statement that the biggest problem in banking is the lack of transparency captured the core of his mission. By turning BnkToTheFuture into a regulated investment bank built on blockchain-powered transparency, he aimed to reshape how financial institutions operate in a digital world.

This move also highlighted his long-term strategy to redefine the role of investment platforms and open up high-value financial opportunities to individuals rather than exclusive corporate groups.

Lifestyle of a Modern Fintech Pioneer

Simon Dixon’s lifestyle reflects his identity as a global entrepreneur and digital nomad. His work frequently takes him across international borders, attending conferences, advising companies, and working closely with investors around the world. He balances a busy professional life with a dedication to education, personal development, and ongoing involvement in technology communities.

Despite his public visibility, Dixon maintains a disciplined and focused routine. He values efficiency, technological tools, and minimalism. His daily lifestyle is shaped by productivity, financial analysis, and continuous learning, qualities essential for someone managing high-profile fintech investments.

While he rarely displays luxury or extravagance, his lifestyle aligns with that of a high-achieving entrepreneur driven by mission rather than materialism.

Family Background and Personal Privacy

Simon Dixon maintains strict privacy around his family and personal life. Unlike many public figures, he chooses not to share details about relationships, children, or extended family tree information publicly. This privacy allows him to focus attention on his professional work rather than the personal side of his life.

What is known is that Dixon comes from a supportive background that encouraged his entrepreneurial thinking and intellectual exploration. His family played an important role in shaping his discipline, curiosity, and commitment to long-term goals. While the specifics remain private, it is clear that his personal support network has been vital to his journey.

Simon Dixon’s Net Worth and Income Sources

As a major investor, entrepreneur, and early Bitcoin advocate, Simon Dixon’s net worth is estimated in the multi-million-dollar range. The exact figure fluctuates dramatically due to the volatility of the crypto market, but his wealth is generated from several primary sources.

First, he holds equity in many early-stage fintech and cryptocurrency companies. These include some of the biggest names in digital finance. As these companies have grown, so has the value of his investment portfolio.

Second, BnkToTheFuture is a major source of income. As CEO and co-founder, Dixon earns revenue from platform fees, equity ownership, and investment activities.

Third, his personal Bitcoin holdings are believed to be substantial. As an early adopter of the currency, he benefited from large price increases over the years.

Finally, his writing, public speaking, consulting, and educational content also contribute to his income streams. While not as significant as his investments, they solidify his role as a respected thought leader in the industry.

Success Story and Long-Term Impact

Simon Dixon’s journey from traditional banker to crypto pioneer is a story of conviction, courage, and timing. He took professional risks at a time when Bitcoin was widely misunderstood and faced scepticism from institutions. His willingness to stand for transparency, innovation, and decentralised finance made him one of the earliest voices calling for reform in global banking.

His success is the result of a long-term vision rather than short-term profit. By building BnkToTheFuture, investing in transformative technologies, and educating millions, he has already left a lasting impact on the financial world.

He remains committed to developing a financial ecosystem where individuals have equal access to wealth creation opportunities, where systems are transparent, and where technology empowers rather than restricts. His story continues to inspire investors, entrepreneurs, and thinkers across the globe.

Social Media Influence and Educational Outreach

Simon Dixon’s influence extends across multiple social media platforms, where he regularly shares insights on Bitcoin, regulation, financial crises, and technological change. His educational videos and livestreams have attracted an international audience, making him an important voice for both new and experienced investors.

His social presence is built on expertise rather than entertainment. He focuses on explaining complex events, offering guidance during market uncertainty, and advocating for transparent policies. His ability to remain calm, factual, and articulate has earned him the trust of a global community.

Future Plans and Continuing Mission

Simon Dixon’s long-term vision includes expanding BnkToTheFuture, supporting regulatory innovation, and helping fintech companies grow through community-powered investment. He continues to challenge outdated financial systems, advocate for fair access to opportunities, and push for global adoption of Bitcoin and blockchain technology.

Whether advising companies, creating educational content, or developing investment infrastructure, he remains dedicated to shaping a financial world that prioritises transparency, fairness, and technological advancement. His journey is ongoing, and his influence continues to grow.

Conclusion

Simon Dixon has become an iconic figure in the world of Bitcoin and fintech because he refused to accept a broken financial system. His journey from investment banker to crypto visionary reflects determination, foresight, and an unwavering belief in transparent finance. Through BnkToTheFuture, his investments, his book, and his public advocacy, he has helped shape how modern financial systems evolve. His success story demonstrates what can happen when intellect, innovation, and purpose come together. As the future of finance continues to transform, Simon Dixon remains one of the most important voices leading the way.

FAQs

What is Simon Dixon best known for?

Simon Dixon is best known for being an early Bitcoin advocate, CEO of BnkToTheFuture, and a leading investor in global fintech and blockchain companies.

What is Simon Dixon’s estimated net worth?

His net worth is estimated in the multi-million-dollar range, largely from Bitcoin holdings, fintech investments, and BnkToTheFuture equity.

Does Simon Dixon have a public family profile?

No. He keeps his family life private and rarely discusses personal relationships or family tree details.

Is Simon Dixon involved in major crypto companies?

Yes. He has invested in more than 40 companies including Bitfinex, Kraken, BitPay, BitStamp, and more.

What book did Simon Dixon write?

He wrote Bank To The Future, a book explaining how technology and cryptocurrency are reshaping the global financial system.

CONNECT WITH US FOR DAILY UPDATES

Business

What Are the Hidden Costs of Inefficient Fuel Management

Fuel plays a critical role in your daily operations. Whether you manage a construction site, a transport fleet, or a manufacturing unit, you need fuel. However, many business owners ignore fuel management, which slowly leads to delays, higher bills, damaged equipment, and wasted resources.

You may feel that your expenses are rising, but you may not immediately link them to fuel issues. Understanding the hidden costs of inefficient fuel management helps you improve efficiency and protect your operations from unnecessary risks.

Hidden Costs of Inefficient Fuel Management

Unexpected Downtime

One of the earliest and most damaging costs you face is sudden downtime caused by fuel shortages. When fuel runs out unexpectedly, your equipment, vehicles, or generators stop working without warning. It leads to delayed deliveries and idle workers waiting for operations to restart. Even a short interruption can affect your entire schedule, especially if your work depends on continuous power or transport.

You can reduce this risk by arranging emergency fuel delivery. It ensures quick access to fuel during urgent situations. Without this support, you may spend hours or even days trying to arrange supplies at the last minute. This delay often costs more than planned fuel deliveries. Over time, repeated downtime damages your reliability and adds pressure to your teams.

Rising Fuel Expenses

When fuel management is inefficient, you often end up buying fuel at the wrong time and at higher prices. Last-minute purchases usually cost more because you have fewer supplier options and less room to negotiate rates. You may also pay extra for urgent transport, which increases your overall fuel expense.

Poor planning also leads to over-ordering or under-ordering fuel. If you buy too much, fuel may sit unused for long periods. It not only results in higher storage costs but also increases the risk of degradation. If you buy too little, you end up re-ordering frequently and paying a considerable amount in terms of delivery charges.

Increased Damage to Equipment

Fuel quality and consistency directly affect how your equipment performs. When fuel is poorly stored or managed, it can become contaminated with water, dirt, or sludge. Using this fuel damages engines, clogs filters, and reduces overall performance. As a result, repairs become more frequent, and equipment life shortens.

You may also push machines harder when fuel supply is uncertain, running them for longer hours once fuel becomes available. It adds extra strain and increases maintenance costs. Over time, you spend more on servicing, spare parts, and replacements. These expenses rarely appear as fuel-related costs on paper. However, they are directly linked to how fuel is handled and monitored within your operation.

Higher Labour Costs

Inefficient fuel management affects your staff as well. When fuel issues arise, workers often spend valuable time dealing with problems instead of focusing on their main tasks. For example, drivers wait for refuelling, operators stop work, and managers rush to arrange emergency supplies.

Repeated disruptions also affect the morale of your team. They may feel frustrated by constant delays and last-minute changes. It leads to slower work, mistakes, and a lack of motivation. Over time, reduced productivity means you need more hours to complete the same work. It means fuel problems can directly increase your overall operating expenses.

Damage to the Business Reputation

When fuel issues cause delays or service failures, your clients notice. Missed deadlines, late deliveries, or power interruptions affect how others see your business. Customers usually judge the outcome, not the reason behind it. Over time, repeated disruptions reduce trust. Clients may choose competitors who appear more reliable.

You may also face pressure to offer discounts or apologies to keep contracts. This loss of reputation is difficult to measure, but it has long-term financial effects. Efficient fuel management supports smooth operations. It helps you maintain strong relationships and protect your professional image in a competitive market.

Compliance Issues

Inefficient fuel management often leads to poor handling of waste oil. Used oil from generators and machinery must be stored and disposed of correctly. When it is ignored, waste oil builds up, leaks occur, and storage areas become unsafe. Handling these issues costs money and creates health and environmental risks.

You can reduce this cost by arranging for professional waste oil collection. It ensures safe and legal disposal. Without professional support, you may face fines and contamination problems.

Theft and Misuse

When fuel management systems are weak, tracking how much fuel is used and where it is used becomes difficult. It creates room for fuel theft, misuse, or unintentional wastage. Ignoring small amounts taken can slowly grow into a serious financial drain. You will end up paying higher fuel bills without a clear reason.

Clear fuel monitoring helps you stay in control. Otherwise, losses remain hidden, and you end up losing all your profits by paying fuel bills.

When you look closely, inefficient fuel management affects every part of your operation. By recognising these hidden costs early, you can control expenses and keep your operations running smoothly.

Celebrity

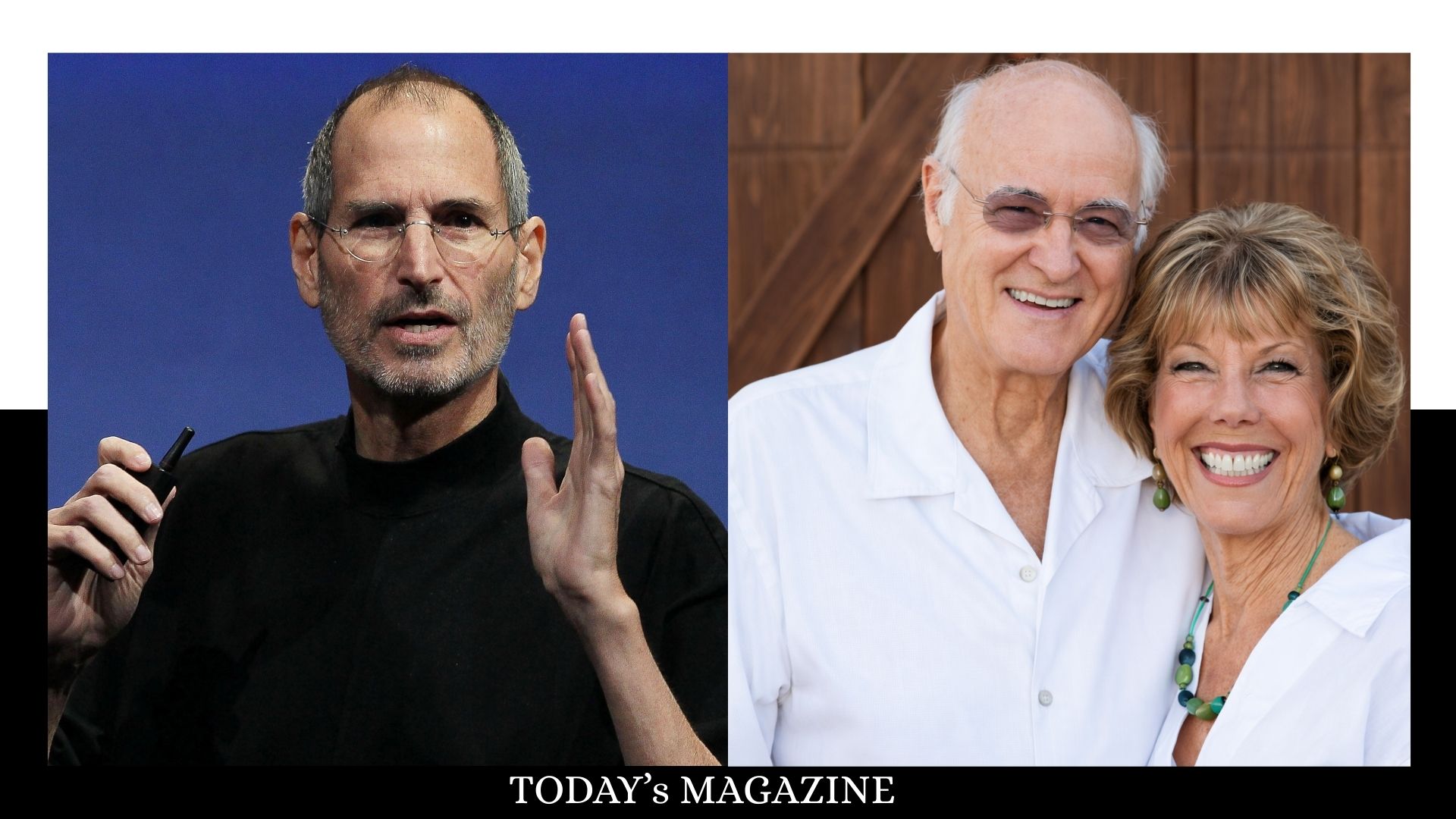

5 Powerful Facts That Reveal the Emotional Story of Joanne Carole Schieble, Steve Jobs’s Biological Mother

Joanne Carole Schieble—later known as Joanne Simpson—is a compelling figure whose life blends personal sacrifice, intellectual ambition, and quiet perseverance. Though she never sought fame, her family tree includes two remarkable personalities: Steve Jobs, the visionary mind behind Apple, and Mona Simpson, a critically acclaimed novelist.

Quick Bio

Category | Details |

|---|---|

| Full Name | Joanne Carole Schieble (later Joanne Simpson) |

| Born | August 1, 1932 – Green Bay, Wisconsin, USA |

| Ethnicity | Swiss-German American |

| Parents | Arthur Schieble & Minni Schieble |

| Famous Children | Steve Jobs, Mona Simpson |

| Profession | Speech-Language Pathologist, Educator |

| Height | 5 ft 5 in (165 cm) |

| Weight | 60–65 kg (132–143 lbs) |

| Estimated Net Worth | $200,000 – $500,000 |

| Marriages | Abdulfattah “John” Jandali; George Simpson |

| Education | University of Wisconsin–Madison; Master’s in Education |

| Known For | Biological mother of Steve Jobs; mother of novelist Mona Simpson |

| Legacy | Quiet resilience, academic devotion, and influence on two major cultural figures |

Early Life and Humble Wisconsin Beginnings of Joanne Carole Schieble

Joanne Carole Schieble was born in Green Bay, Wisconsin, where she grew up on her parents’ mink farm among real estate holdings. Her upbringing was traditional, rooted in Catholic values and Swiss-German discipline. This environment shaped her grounded lifestyle, encouraging academic excellence.

As a young woman in the 1930s and 40s, she faced societal limits placed on women, yet she consistently excelled in school. These early accomplishments foreshadowed the determination she would carry into her career, relationships, and the defining decisions of her journey.

Academic Strength and Pursuit of Speech Pathology

Studying at the University of Wisconsin–Madison, Joanne Carole Schieble pursued speech pathology—a progressive and ambitious field for women at the time. Joanne Carole Schieble later earned a master’s degree in education, cementing her reputation as a thoughtful and intellectually driven woman.

Her work as a speech-language pathologist placed her in classrooms, clinics, and academic circles where she dedicated herself to helping children overcome communication challenges. Her devotion to education became a hallmark of her lifestyle, and it contributed more to her personal success than any financial measure.

Meeting Abdulfattah Jandali and the Beginning of a Complicated Romance

During university life, Joanne met Abdulfattah “John” Jandali, a Syrian political science student. Their relationship blossomed academically and emotionally, but cultural tensions created sharp divides. Her conservative father disapproved of the romance and threatened to disown her if she married a non-Catholic foreigner.

This conflict became one of the most defining chapters in her family tree, influencing the circumstances of Steve Jobs’s birth and adoption. Joanne’s struggle illustrates the restrictive lifestyle norms imposed on women in 1950s America.

The Secret Pregnancy and the Birth of Steve Jobs

In 1954, Joanne Simpson became pregnant with her first child—Steve Jobs. Fearful of family backlash and societal judgment, she traveled to San Francisco to give birth in secret on February 24, 1955. She insisted that her baby be adopted by educated parents, believing education to be the foundation of success.

Initially, she rejected Paul and Clara Jobs due to their lack of college degrees. However, after they promised to fund Steve’s future education, she agreed to the adoption. This decision, born from love and circumstance, became one of the pivotal origin points in both Steve Jobs’s life and the technological revolution he later led.

Adoption Decision and the Role it Played in Her Family Tree

Joanne’s adoption decision was not simply an act of surrender but one rooted in intention and belief in opportunity. Her insistence on education as a requirement reflected her enduring commitment to intellectual growth, a core part of her lifestyle.

This moment drastically shaped her family tree, introducing a separation between mother and son that lasted until adulthood. Though the choice deeply affected her, it also underscored her emotional strength and capacity for selflessness.

Marriage to Jandali and the Birth of Mona Simpson

Six months after Steve’s adoption, Joanne married Abdulfattah Jandali once her father passed away. In 1957, she gave birth to their daughter Mona, who would later become the celebrated novelist Mona Simpson.

Raising Mona offered Joanne a second chance at motherhood. She poured her academic drive and nurturing spirit into her daughter’s upbringing. Many credit her unwavering support and intellectually rich lifestyle for Mona’s literary success.

Divorce and Transition into a New Life Chapter

By 1962, Joanne and Jandali divorced after years of cultural conflict and personal differences. Joanne moved forward with resilience, taking on the responsibilities of raising Mona while continuing her career in speech therapy.

This period further reflected her capacity to rebuild and redefine her lifestyle, prioritizing stability, education, and emotional well-being.

Marriage to George Simpson and Stability in Los Angeles

Joanne later married George Simpson, providing a new foundation for her family tree. Both she and Mona adopted his surname, and they relocated to Los Angeles, where Joanne continued her work as an educator and speech-language pathologist.

Her marriage offered a quieter, structured lifestyle, aligned with her preference for privacy and simple living. Though her net worth remained modest, her sense of fulfillment came from academia, family, and personal purpose rather than wealth.

Reconnection with Steve Jobs in Adulthood

Steve Jobs reconnected with Joanne Simpson in the mid-1980s after searching for his biological roots. Their reunion was marked by respect, curiosity, and emotional healing. Jobs later spoke kindly of Joanne and acknowledged the difficult circumstances she faced.

While she never appeared in social media or embraced public life, her influence became part of Jobs’s personal story, symbolizing the strength of maternal sacrifice.

Lifestyle and Personality of Joanne Carole Schieble

Joanne lived a quiet, intellectually grounded lifestyle. She never sought fame or recognition for being the biological mother of a tech icon. Instead, she focused on:

- Education and academic work

- Raising Mona with stability

- Avoiding public attention and social media

- Maintaining deep-rooted values shaped by her upbringing

Her personality combined humility, determination, and emotional restraint. These traits shaped her success in navigating personal challenges and supporting her children.

What is Joanne Carole Schieble’s Net Worth?

Joanne Simpson’s net worth was estimated between $200,000 and $500,000. Unlike high-profile figures connected to Silicon Valley, she did not acquire wealth from Steve Jobs or Apple. Her assets came from:

- Her career in education and speech therapy

- Middle-class earnings

- Real estate and savings accumulated over decades

- Marriage to George Simpson

Her modest net worth reflects a life built around purpose rather than luxury. Her true success was measured in resilience, family, and contribution to the lives of others.

Her Legacy as the Mother of Two American Influencers

Joanne Simpson remains a central figure in the family tree of two extraordinary individuals: Steve Jobs and Mona Simpson. Her choices influenced Jobs’s adoption environment, while her nurturing shaped Mona’s creative path.

Her legacy includes:

- Empowering Mona’s literary career

- Contributing indirectly to Jobs’s global impact

- Demonstrating the quiet success of a woman who persevered despite societal constraints

- Inspiring future generations through her story of sacrifice and strength

Her life reminds us that greatness often grows from unseen roots.

Why Joanne Carole Schieble’s Story Matters Today

In modern discussions of innovation and family histories, Joanne’s story offers valuable insight into how private lives shape public success. Her journey resonates with themes of independence, motherly sacrifice, cultural conflict, educational passion, and personal identity.

Her lifestyle, values, and emotional resilience created ripples that influenced the worlds of technology and literature—two fields rarely connected but forever joined through her family tree.

Conclusion

Joanne Carole Schieble’s life is a testament to quiet strength, emotional resilience, and the power of choices made during some of the most challenging decades for women in America. Her story goes far beyond being the biological mother of Steve Jobs and Mona Simpson—it reflects a woman who built her own identity through education, service, and unwavering devotion to her family. Her lifestyle, rooted in humility and academic purpose, shaped two extraordinary figures whose achievements transformed technology and literature. Though her net worth was modest, her true success lives on through the global cultural impact of her children and the profound emotional legacy she left behind. Joanne’s journey reminds us that behind every revolutionary story lies a deeply human narrative of sacrifice, love, and courage.

FAQs

What was Joanne Carole Schieble’s profession?

Joanne Simpson was a respected speech-language pathologist and educator dedicated to helping children with communication challenges.

What was her estimated net worth?

Joanne Simpson’s net worth ranged from $200,000 to $500,000, reflecting a modest middle-class life focused on education and service.

Did Joanne maintain a relationship with Steve Jobs?

They reconnected in adulthood, building a respectful relationship after Jobs searched for his biological family.

How did Joanne influence the success of her children?

Her commitment to education, emotional resilience, and stable lifestyle helped shape both Jobs’s and Mona Simpson’s paths.

Was Joanne active on social media?

No, she maintained a completely private life with no social media presence, preferring an intellectually driven and quiet lifestyle.

Business

Top 7 Benefits of Using a Professional Commercial Laundry Service for Your Business

Running a successful business means grasping the art of delegation, identifying which tasks drain resources and which drive revenue. Internal laundry management is an expensive and often overlooked burden for any business that relies heavily on linens, uniforms, or towels, from flourishing eateries to busy clinics and booming hotels. Staff time, utility budgets, and managerial capacity are all severely impacted by this problem, which goes beyond simple inconvenience.

The full cost of in-house laundry becomes apparent when you factor in the high cost of industrial equipment, unpredictable repair expenses, and the sheer number of labour hours required for washing and folding. Laundry is not an additional duty; instead, it consumes working capital and diverts workers from their primary responsibilities. A specialised partnership that totally removes these burdens is the alternative.

This is why moving to a professional commercial laundry service is a definitive strategic upgrade. In this guide, we will detail the seven key benefits that demonstrate why this transition is essential for any business focused on maximising its bottom line and future growth.

1. Maximise Staff Productivity and Reclaim Time

In-house laundry drains precious operational time and diverts staff away from core duties. Utilising a professional commercial laundry service immediately converts time spent on washing and folding into time dedicated to revenue generation.

Reallocate Employees to Revenue-Generating Tasks

Professional commercial laundry service providers assume all washing, drying, and folding responsibilities for your fabrics. This transition allows your staff to focus entirely on customer service and specialised business tasks.

By removing laundry logistics from your team’s workload, you unlock higher productivity. The value is realised when skilled employees are focused exclusively on their profit-driving roles.

2. Achieve Significant Operational Cost Savings

While outsourcing involves a service fee, it systematically eliminates unpredictable capital costs and high variable utility expenses. This crucial shift makes your financial forecasting more reliable and your operational spending predictable.

Eliminate Capital Expenditure and Maintenance Costs

Purchasing industrial-grade laundry equipment involves a significant financial outlay. This requirement for large equipment purchases and expensive, unforeseen repairs is eliminated by outsourcing.

The professional provider assumes all financial risks related to equipment maintenance and downtime. As a result, your company is spared the entire cost of maintenance and depreciation.

Comparison Table of In-House vs. Commercial Laundry Service

| Cost Component | In-House Laundry (Hidden Costs) | Commercial Laundry Service (Predictable Costs) |

| Capital Investment | Required (Purchasing industrial washers/dryers) | Zero (Provider owns all equipment) |

| Maintenance & Downtime | High risk, unpredictable costs, and operational disruption | Zero risk (Maintenance handled by provider) |

| Utility Consumption | High (Less efficient machines, increased water/energy bills) | Low (Industrial, high-efficiency machinery used) |

| Labor Costs | Dedicated internal staff, payroll, and managerial oversight | Zero (Staff reallocated to core business tasks) |

| Quality & Consistency | Inconsistent, prone to staff error, and fabric wear | Guaranteed high quality, professional stain removal, and consistent finish |

3. Guarantee Superior Quality and Consistent Results

Your brand standards and client experience are immediately reflected in the cleanliness and presentation of your uniforms and linens. Expert services, like Love2Laundry London, enhance the longevity and visual appeal of your fabrics through specialised techniques.

Professional-Grade Cleaning Elevates Your Brand Image

Standard machines cannot match the specialised industrial processes and premium, commercial-grade detergents used in commercial laundry service. This specific care ensures precise folding and consistent quality, resulting in a superb finish.

Items that are regularly processed and expertly cleaned improve your brand’s reputation with customers. By maintaining the fabric’s integrity, this attention to detail delays costly replacements.

4. Maintain Strict Hygiene and Compliance Standards

Cleaning is a legal need, not merely a choice, for companies in delicate industries like healthcare or food service. Expert providers are prepared to regularly fulfil these vital health and safety regulations.

Utilising High-Temperature Cycles to Eliminate Pathogens

Industrial equipment for specialised cleaning and sanitation is technically installed in commercial laundry services. They use potent compounds and high-temperature washing cycles to remove germs, oils, and grime efficiently.

This knowledge provides clinical-grade cleanliness by eliminating bacteria and germs. Your company’s liability for cross-contamination hazards is decreased when you rely on an expert.

5. Foster Smooth Business Growth and Scalability

Rapid business growth often outpaces internal operational capacity, requiring expensive equipment upgrades. An outsourced service offers instant, flexible capacity that scales precisely with demand.

Handling All Volume Fluctuations Without Investment

Industrial equipment used by commercial services is prepared to manage any load volume, from routine maintenance to unforeseen spikes. This offers the vital flexibility needed for unanticipated business growth or seasonal demands. As your firm grows, you can avoid buying pricey industrial washing equipment. This strategy assures capacity when you need it most and zero interruptions.

6. Convenience via Laundry Delivery Service

The logistical ease provided by modern pickup and delivery transforms laundry management from a complicated chore into a predictable, passive service. This logistical efficiency further supports the overall workflow.

Reliable Door-to-Door Pickup and Quick Turnaround

A core feature is door-to-door pickup and delivery, eliminating all transportation hassles for your staff. Providers offer flexible scheduling options that integrate smoothly with your operational hours.

The laundry delivery service guarantees reliable return, often within 24 to 48 hours. This reliable turnaround allows you to maintain a lean inventory, saving capital on excess stock.

7. Optimise Valuable Business Space and Resources

Commercial real estate is expensive, and every square foot must be maximised to achieve the highest revenue potential. Outsourcing helps convert non-revenue-generating areas into profitable spaces.

Free Up Square Footage for Revenue-Generating Operations

By outsourcing, your business can free up space now occupied by enormous dryers, washing machines, and folding tables. Essential business operations, like setting up dining tables or store displays, can immediately take advantage of this extra square footage. Particularly in cities with high rental rates, this conversion offers a substantial return on investment. For higher-value processes, it increases the efficiency of your area.

Conclusion!

In conclusion, outsourcing laundry is a calculated step toward operational excellence. By changing labor costs and capital risks, businesses can quickly boost employee productivity and obtain better financial certainty. Notably, expert cooperation guarantees rigorous respect to hygienic requirements and uniform quality, preserving brand integrity throughout all garments.

When combined with the logistics of a reliable laundry delivery service, this model ensures seamless scalability, allowing the company to repurpose valuable operational space for revenue generation. Therefore, utilising a professional commercial laundry service is the clearest path to mitigating risk and achieving agile, sustainable growth.

-

Celebrity3 months ago

Celebrity3 months agoWho Is Maisie Mae Roffey? The Private Life, Family Story, and Quiet Success of Julie Walters’ Daughter

-

Celebrity2 months ago

Celebrity2 months agoRoy Hodges: Biography, Lifestyle, Net Worth, Family & Success Story (2025)

-

Celebrity1 month ago

Celebrity1 month agoDraven Duncan: Tim Duncan’s Rising Star Son and His Inspiring Basketball Journey

-

Celebrity1 month ago

Celebrity1 month agoWho Is Daniel Clifton Pratt? Inside the Life, Family Values, and Legacy Behind Chris Pratt’s Father

-

Celebrity3 months ago

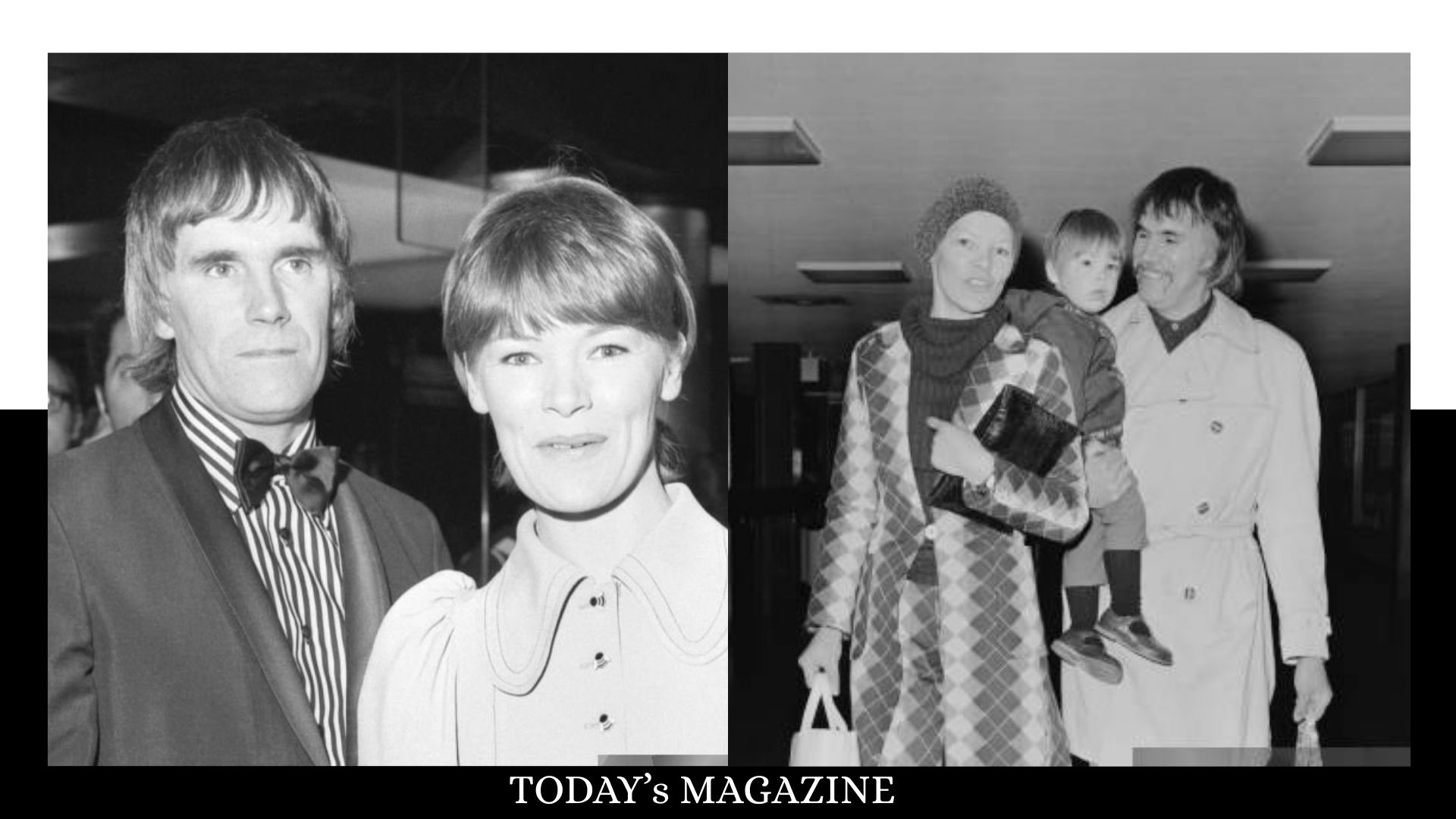

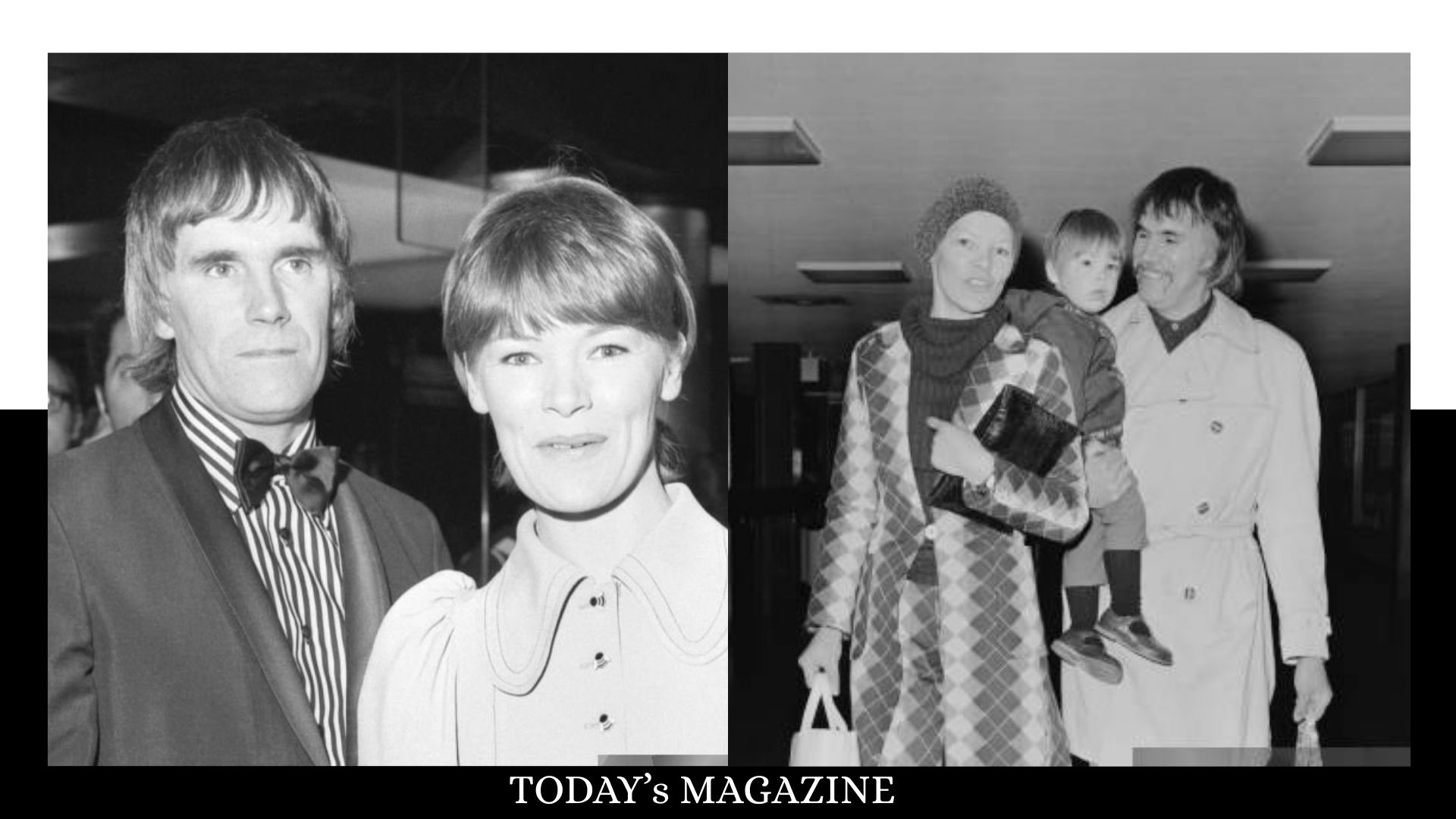

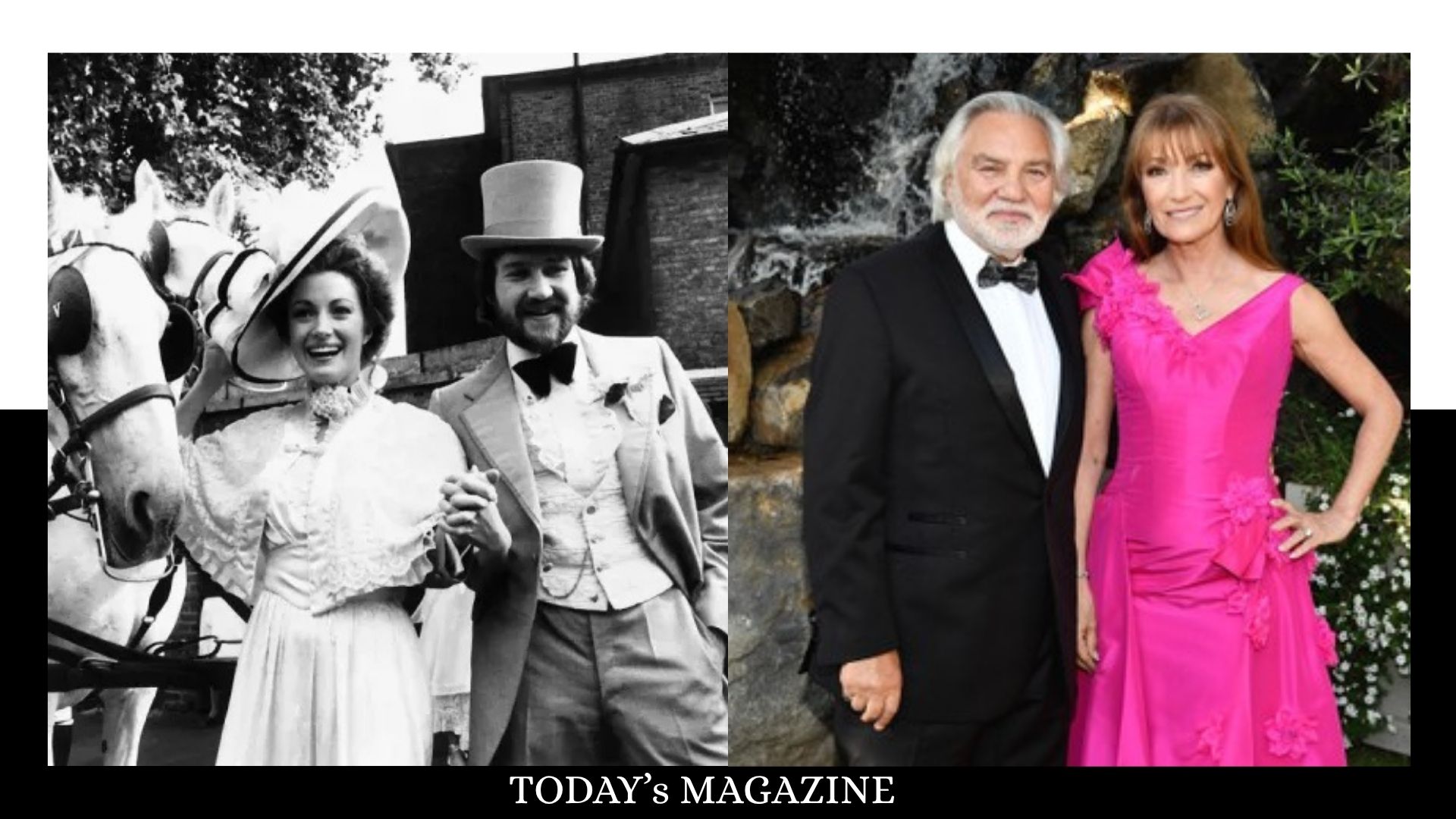

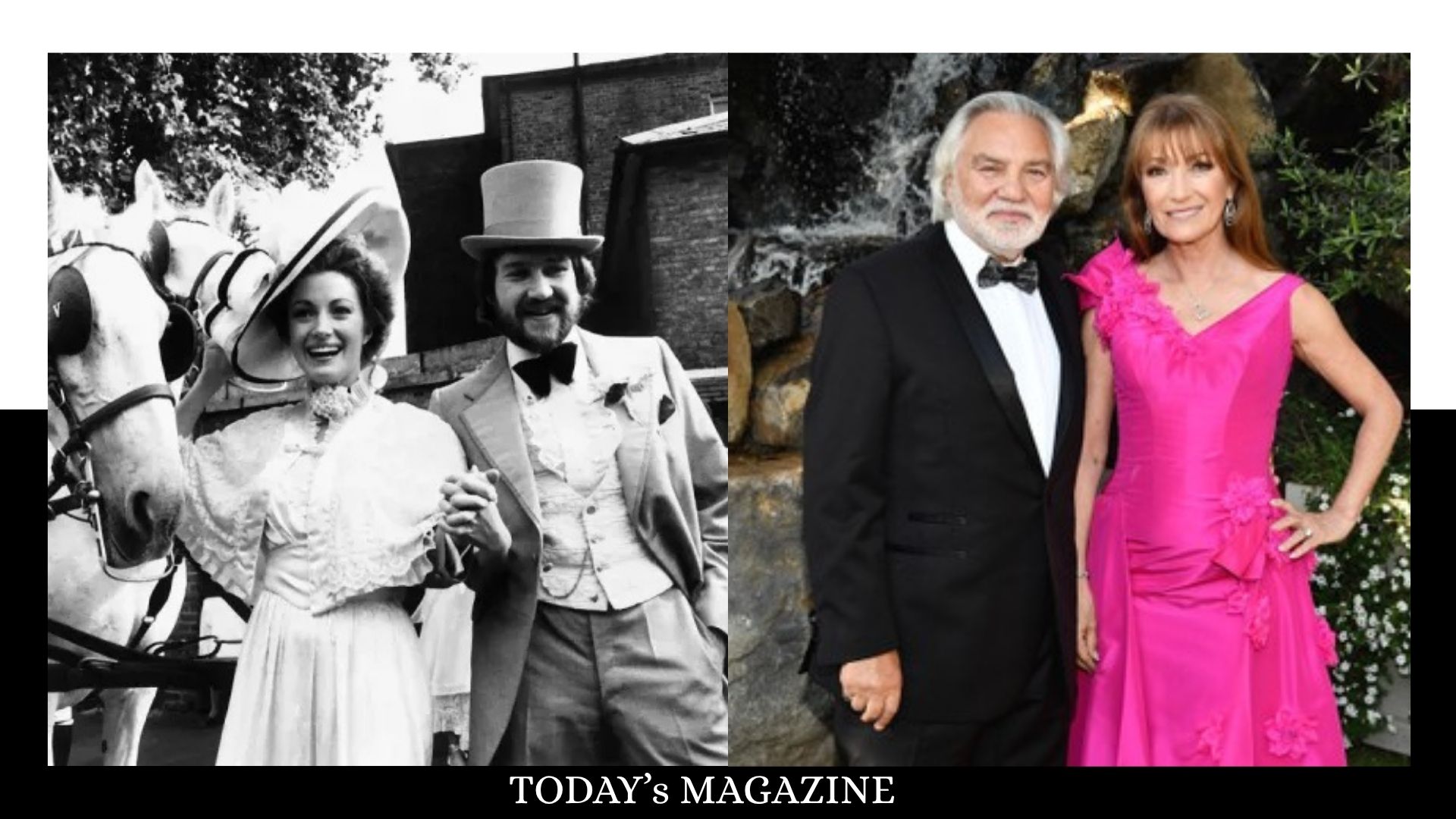

Celebrity3 months agoGeoffrey Planer: Lifestyle, Net Worth, Family, and Success Story of Jane Seymour’s Ex-Husband

-

Celebrity3 months ago

Celebrity3 months agoNancy Hallam: The Inspiring Life, Career, and Success Story Behind Ian Wright’s Wife

-

Celebrity3 months ago

Celebrity3 months agoGeorgie Lowres: The Private Life and Story of Taylor Hackford’s Ex-Wife

-

Celebrity1 month ago

Celebrity1 month agoWho is Sheila Page?All About Nick Nolte’s First Wife, Her Story Behind the Spotlight